The new leasing standard (ASC 842) will impact all GAAP financial statements next year. This new standard will affect every company issuing GAAP financials that has any type of lease agreement (office lease, copy machine, auto lease, etc.). Under the new standard, all leases, regardless of being capital or operating leases, must be reported on the balance sheet as an asset with a related lease liability. Complying with this standard will be a tedious task and will also impact income tax liability.

Solutions to consider include the use of lease software tools and/or changing from GAAP to a recent smaller company alternative (Little GAAP). Changing to “Little GAAP” may require lender approvals due to existing loan covenants.

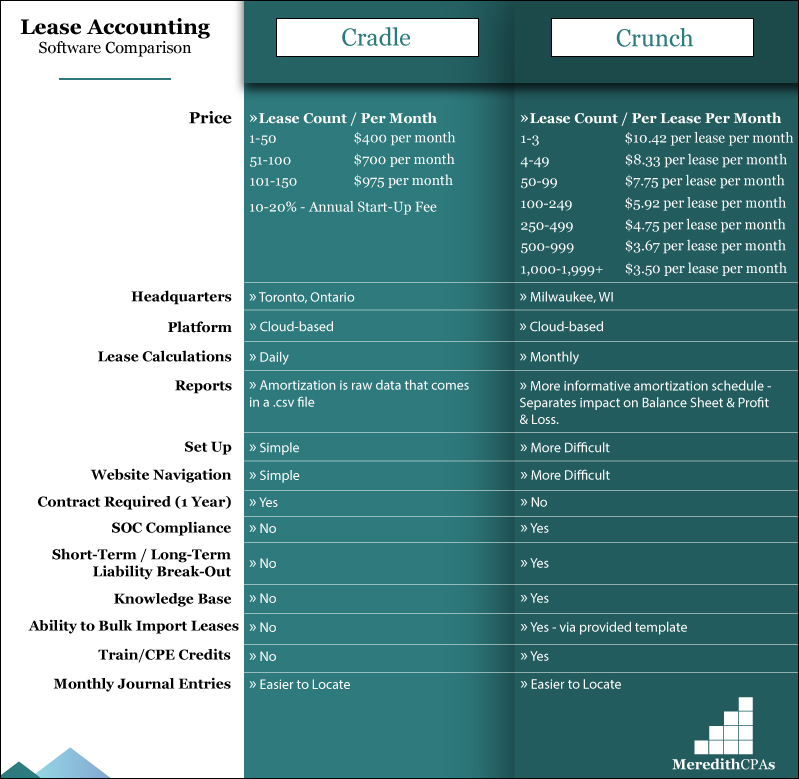

We have analyzed various software tools to assist with lease tracking and on-going calculations. We recommend either Lease Cradle or Lease Crunch and have included a comparison chart of the two tools below.

About changing from Big GAAP to Little GAAP – please call us to discuss further.

We hope this information helps you plan for the significant accounting and tax challenges heading our way next year.

If you have any questions, please contact us.